Tax rebate for Self. In years 2012 2013 and 2014 the taxpayer timely requested extensions to file tax returns for the prior year.

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others.

. We recommend ensuring that your HR software is LHDN-approved like Talenox. You will need to export this file so you can import it into e-Data PCB later on. The existing standard rate for GST effective from 1 April 2015 is 6.

For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. Guide To Using LHDN e-Filing To File Your Income Tax. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

For the assessment year 2022-23 as many as 58288962 people have filed Income Tax Returns so far. State e-file not available in NH. Headquarters of Inland Revenue Board Of Malaysia.

This tax rebate is why most Malaysia n fresh. The IRS issues more than 9 out of 10 refunds in less than 21 days. The taxpayer worked as a partner at a law firm from 2011-2015.

When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up. Below is an example of how a PCB bank file. Most personal state programs available in January.

Start by exporting the PCB bank file generated by your HR software. Learn how to file back tax returns with the IRS. People may get behind on their taxes unintentionally.

The economy of Malaysia is the third largest in Southeast Asia and the 34th largest in the world in terms of GDP. Get your tax refund up to 5 days early. How Does Monthly Tax Deduction Work In Malaysia.

If you were self-employed as a sole trader in the last tax year 6 April 2020 to 5 April 2021 and earned more than 1000 you need to file a tax return. State e-file available for 1995. As such they may require you to donate a set minimum amount if you wish to claim for tax exemptions.

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. Tax File Registration. The deadline to file the Income Tax Returns ended on Sunday July 31.

However there are individuals and entities who are. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. Fastest refund possible.

For partnerships their tax identification number is ninea unique -digit Business Number BN issued by the Canada Revenue Agency. The Goods and Services Tax GST is an abolished value-added tax in Malaysia. How To Pay Your Income Tax In Malaysia.

You could be audited not because your return is late but because the IRS thinks the return has errors. Fastest tax refund with e-file and direct deposit. How To Pay Your Income Tax In Malaysia.

SG 00587682020 or SG 587682020 C 9002512302 or TF 0054356209. The 2010 protocol entered into force on 28 December 2010 and is effective in both countries for tax years from 1 January 2011. Corporation Tax from 1 April 2020 Income Tax and Capital Gains Tax from 6 April 2020 in India for taxes withheld at source on amounts paid or.

According to the Income. Personal state programs are 3995 each state e-file available for 1995. So in case the income is higher than Rs25lakh and you are looking for various tax deductions to bring your income below that level then it is important to file income tax returns.

If the IRS wants to pursue tax evasion or related charges it must do so within six years generally running from the date the unfiled return was due. State e-file not available in NH. The 2018 labour productivity of Malaysia was measured at Int55360 per worker the third highest in ASEAN.

Under different sections of Income Tax Act it is mandatory to file income tax return in order to avail tax benefit even if you dont have the tax liability. The IRS will evaluate any back tax return you file in basically the same way it evaluates all returns. Tax Offences And Penalties In Malaysia.

If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. As you begin to file your taxes this year armed with receipts of eligible purchases to help you maximise tax reliefs dont forget to include your donations gifts of money and contributions as well. Tax refund time frames will vary.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. For more information on the BN including how to apply for one Business Number BN go to. Example for earlier version of ITN.

How Does Monthly Tax Deduction Work In Malaysia. According to the Global Competitiveness Report 2021 the Malaysian economy is the 25th most competitive country economy in the world. You will be granted a rebate of RM400.

In 2019 the California Bar placed him on involuntary inactive. Partnerships required to file a partnership return in Canada or with commercial affairs in Canada are required to have a BN. Guide To Using LHDN e-Filing To File Your Income Tax.

In addition Malaysia is. Of Malaysia IRBM are assigned with a Tax Identification Number TIN known as Nombor Cukai Pendapatan or Income Tax Number ITN. Businesses that provide taxable goods and services must register for SST if they meet the following conditions.

Heres more about what happens when you file back tax returns. The complete texts of the following tax treaty documents are available in Adobe PDF format. Which businesses must apply for sales and service tax registration in Malaysia.

Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Perhaps there was a death in the. 2010 Malaysia-UK Protocol - in force.

Do note that the PCB Bank File must be in txt format. Tax Offences And Penalties In Malaysia. Total sales value within the last 12 months exceed RM 500000.

For most tax evasion violations the government has a time limit to file criminal charges against you. Tax File Number and sometimes it is not. A tax rebate reduces the amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2021.

Release dates vary by state. WWF Malaysia for instance requests. However the taxpayer failed to timely file his return by the October 15 extension deadline for each year.

You must also file one if you were a partner in a business partnership or director of a limited company whose income was not taxed at source andor have further tax to pay. If your chargeable income does not exceed RM 35000 after the tax reliefs and deductions. E-file fees do not apply to NY state returns.

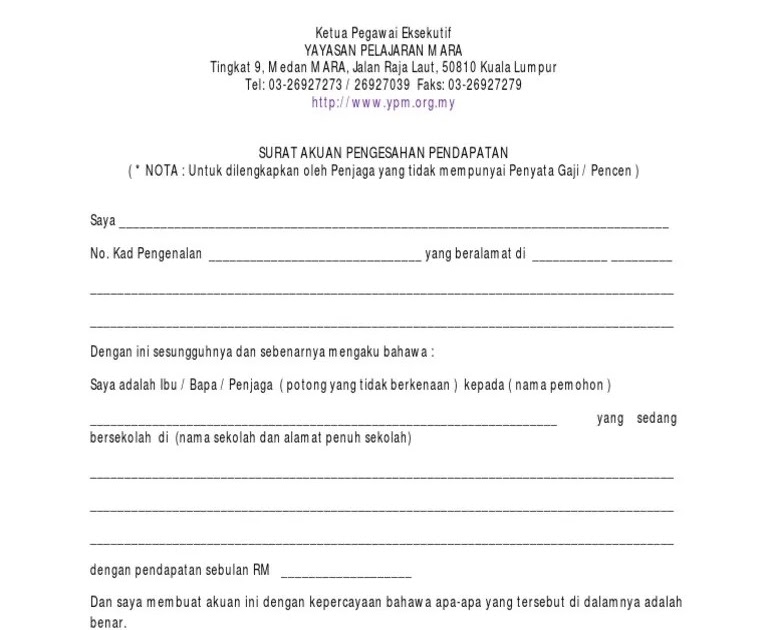

Cukai Pendapatan How To File Income Tax In Malaysia

How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube

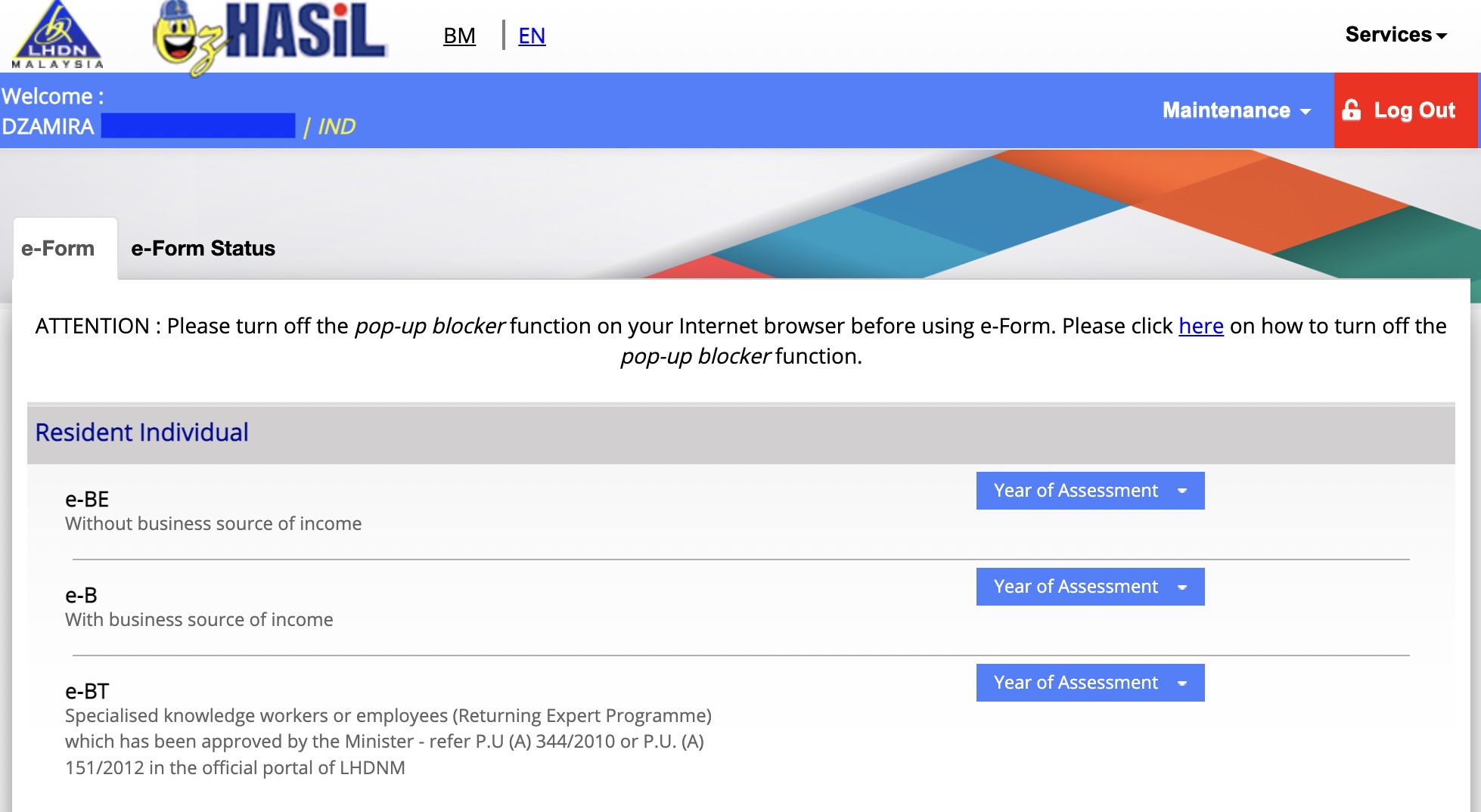

Guide To Using Lhdn E Filing To File Your Income Tax

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Individual Income Tax In Malaysia For Expatriates

How To File Your Taxes For The First Time

7 Tips To File Malaysian Income Tax For Beginners

Guide To Using Lhdn E Filing To File Your Income Tax

The Complete Income Tax Guide 2022

7 Tips To File Malaysian Income Tax For Beginners

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Malaysia Personal Income Tax Guide 2021 Ya 2020

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

How To Step By Step Income Tax E Filing Guide Imoney

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Watch This Before Filing Income Tax 2022 Pt 1 Complete Guide To File Tax Returns In Malaysia Youtube

Filing Your Taxes For The First Time In Malaysia Read This First Ya 2021 Althr Blog